Account aggregation: From first principles

The economics of the AA ecosystem

In academic economics, it can be helpful to think through complex real world problems by working with simple abstractions. This is, typically, a toy model of the world.

To do so, it can be helpful to specify a few things.

Who are the agents? What are their incentives?

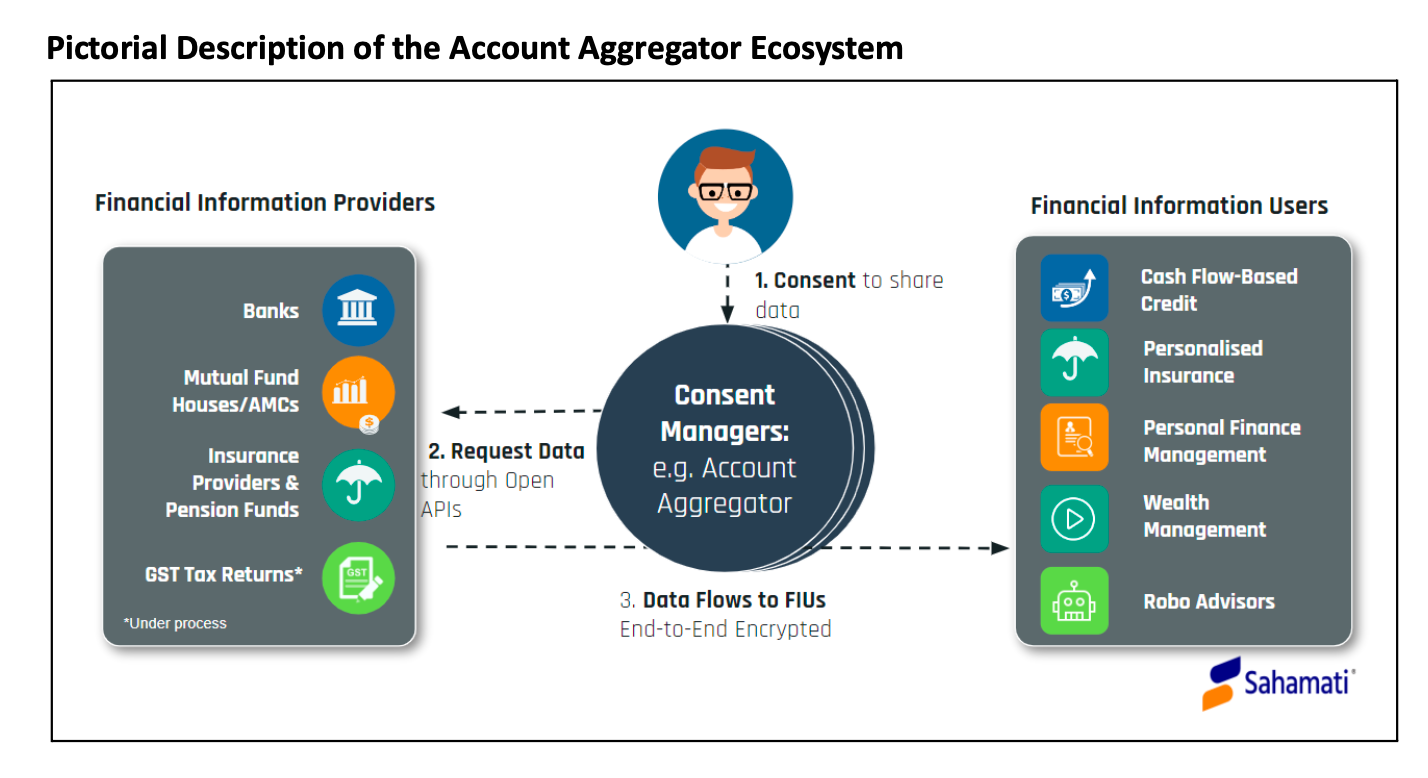

In the account aggregator ecosystem, there are 4 types of players. Each player has different objectives, strategies and constraints.

Financial Information Providers

These are financial institutions such as banks, insurance providers, asset management companies, tax office, etc. They typically operate in different business segments and generate useful consumer data.

Objective: To increase future profits

Rule: Share data if future profits with sharing data > future profits without sharing data

Constraint: If the rule does not apply but the regulator mandates data sharing, then the rule is overwritten by the “regulatory constraint”

Using game theory, one can postulate that there can only be one equilibrium in a world where there is no regulation: Nobody shares the data. This is because any player who is part of the ecosystem has incentive to not share data. When they do not share data, they have access to both their own private information and public information, thus, they have a competitive advantage.

Hence, regulation needs to mandate data sharing to move to a better state of the world where Everybody shares the data.

In reality, current regulation is somewhere in between where regulators have encouraged only large financial institutions to join the AA ecosystem. In the early stages of AA ecosystem, RBI, SEBI and PFRDA came out with enabling circulars for their respective entities to join the AA Ecosystem. By October 2022, these cross-sectoral efforts led to adoption by 23 FIPs and 78 FIUs. As of June 2024, the AA ecosystem has been adopted by 60 FIPs and 353 FIUs.

The question remains: why would other financial institutions voluntarily join AAs? The answer is simple: Improved distribution

The rise of competition in last-mile distribution of financial services due to open banking is leading to snow-ball effect where the increase in competition is nudging larger players (FIPs) to partner with smaller players (FIUs). Following the old adage:

“If you can’t beat them, join them”

Thus, joining the AA ecosystem helps improve distribution of last-mile services via APIs due to greater competition and inclusion from new entrants in the financial sector.

Financial Information Users

These are traditional financial institutions and fintech start ups which are building businesses in diverse consumer verticals to cater to different business needs.

Objective: Improve future cashflows

Rule: Join the AA ecosystem if future profits from data access > initial set up cost + linear pricing for handling data requests (paid to AAs)

The future profits from data access depend on the use cases identified by traditional financial institutions and new fintechs. This means that: AAs have the incentive to help identify use cases for FIUs who handle the operational aspects of consumer fintech.

Just like most B2B business, AAs have incentive to improve the profits of customers, thus, making it a positive sum game. Both AAs and FIUs are aligned in identifying new use cases. Thus, making this a truly innovative business model which improves productivity and efficiency in the financial sector!

Account Aggregators

These are technology companies which are supporting businesses.

Objective: To increase partnerships with FIUs, thus, leading to increase in commissions in the form of initial on-boarding fees and future commissions for handling data requests

Rule: The size of the AA is limited by the benefits of future cash flows from additional partnerships to the cost of building and servicing a new partnership

Thus, AAs can scale when 1) They help FIUs find opportunities to start and bring more business 2) They lower the cost of building and servicing a new partnerships building awareness through marketing campaigns, white papers and evangelising the new business model.

Consumers

These are consumers which are trying the access better services or products for a given price.

Objective: To obtain cheaper or improved services

Rule: Give consent if the value of allowing access to cheaper or improved services > value of privacy or convenience

Most use cases proposed by AAs/TSPs and executed by FIUs are built to benefit end-consumers. Thus, an awareness of consumer pain points is necessary to build use cases which are functional and user-friendly. Product market research, testing and documenting success are all important in building products whose success can be replicated multiple times by different FIUs.

Thus, consumers are more likely to provide consent if better use cases are designed which provide access to cheaper or improved services. They are also more likely to give consent if the process is seamlessly integrated into their life i.e., it is easier to give consent of existing apps than to install a new app, or if the consumer is convinced on the safety of giving access to their information, typically via regulatory guidance within the UI.

What is the state of the world they operate in?

This could be the state of technology, regulation or funding opportunities which typically become additional constraints.

Technology : New technologies can give rise to additional use cases which become market opportunities for new products. For example, this recent news of large language models in the financial sector by Setu AA.

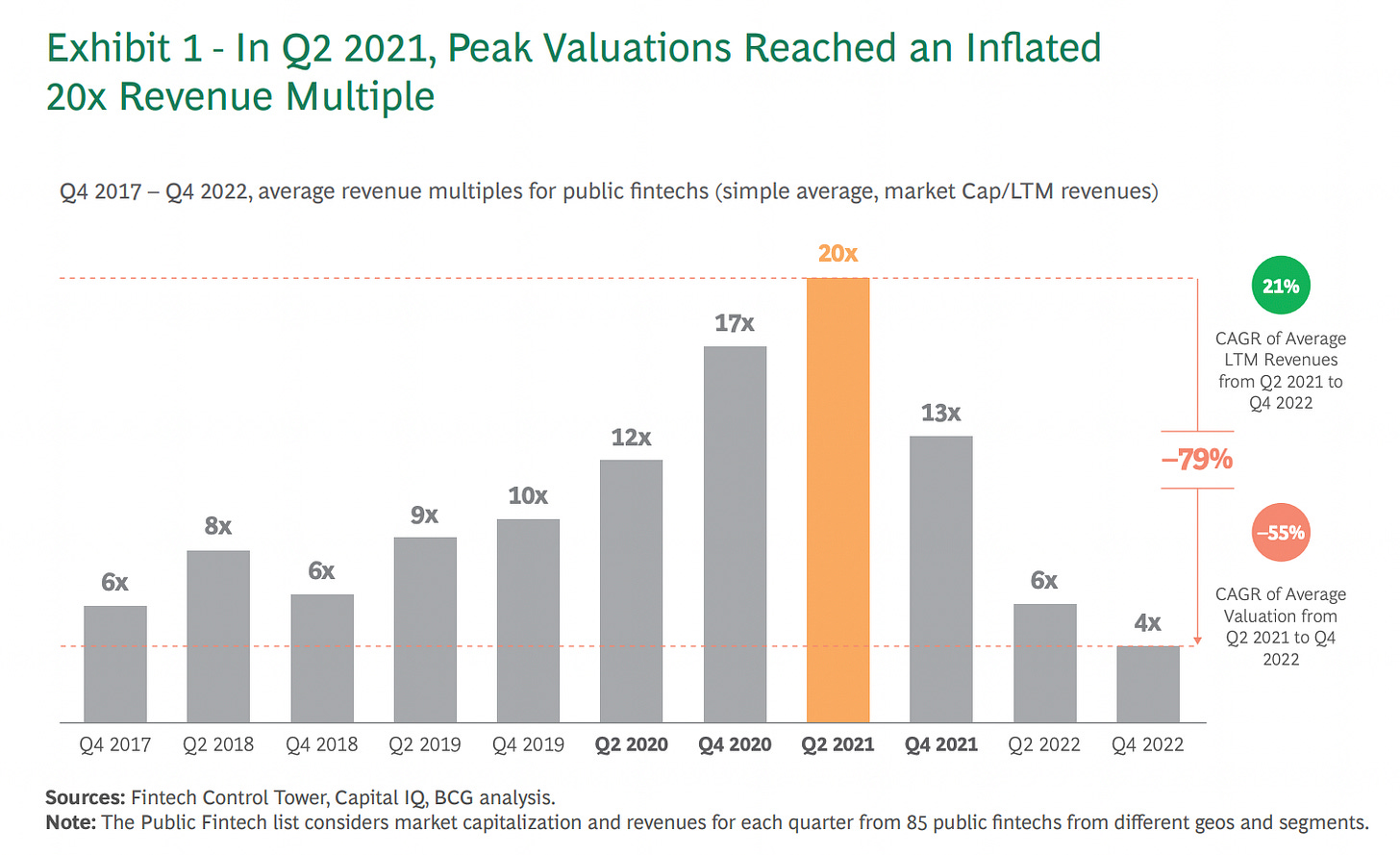

Markets: Global funding ebbs and falls in the financial market. Periods of high market funding may also be associated startup creation. As AA model relies on traditional and new financial companies to build on top of the AA infrastructure, funding dry-ups may lead to fewer partnerships and lower revenues.

Regulation: Regulation impacts the cost and convenience of joining the AA ecosystem directly. Regulation also impacts the AA business model indirectly. As fintech companies may be subject to higher regulatory oversight, this directly affects fintech growth, and indirectly affects growth of AA companies.

Industry Forecast

Now that we have delineated the different components of the stakeholders of the AA ecosystem, we can make projections of industry and market trends broadly.

Technology: Early use cases in the AA ecosystem have primarily been in credit where banks and NBFCs have reported improved operational efficiency and higher profits. Yet, there is still massive value to be unlocked in improving product design in credit such as small ticket size/ high volume loans in rural/Tier-2 and 3 cities.

As new data types become available, there are more ways technology can be leveraged to improve product offerings, product marketing and develop more business models. 1Funding: Despite the current fintech funding winter, fintech industry is a sound long-term bet in APAC as a large population in underbanked and underserviced. There is also more scope for digitisation of non-banking financial services such as insurance and wealth management.2

Regulatory: As different types of financial institutions are regulated by different financial regulators such as RBI, SEBI, IRDAI, PFRDA. Regulatory burden on both FIUs and AAs impacts the speed of adoption of new use cases. Further, the data protection bill 2023 impacts the ease of adoption of by consumers.

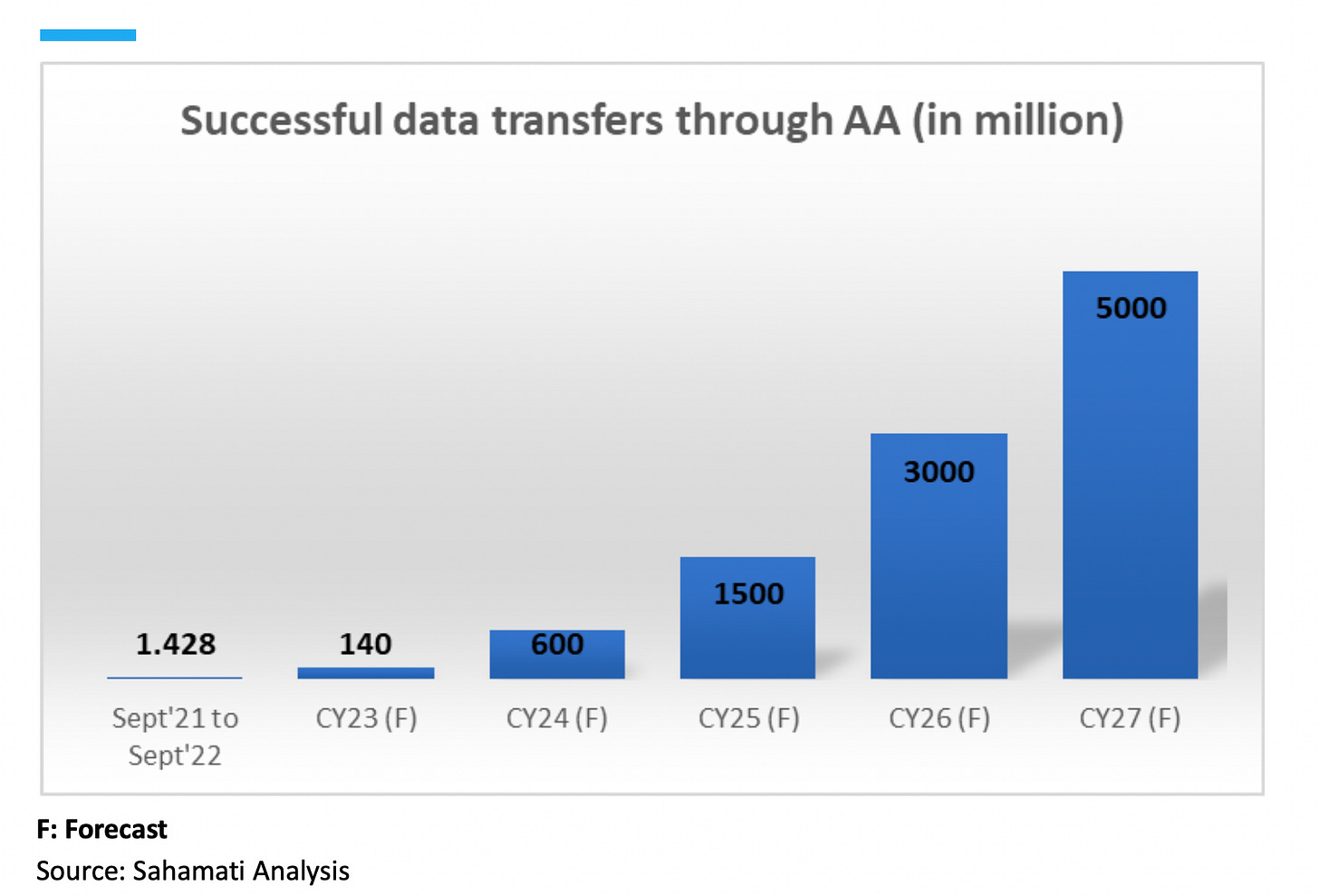

Political continuity in the Indian context means that the policy support for AA initiatives continues. We would look for the new financial budget on July 25 for further regulatory updates on the AA ecosystem to build on past announcements and plans.3Market sizing exercises conducted the non-profit Sahamati show projected data transactions on AA to grow to 1 billion by 2025 and 5 billion by 2030.

These projections are built on expected use cases across different financial sectors and expected timelines of adoption as on November 2022. However, in practice the observed data transfers through AA fall much shorter at only 80 million cumulative requests by Q2 2023.

Now that we have an understanding of the economics of the AA ecosystem, the question remains: Where are the key pain points that lead to lower adoption?

If you are a stakeholder in the AA ecosystem, feel free to write to me at meghana.yerabati@insead.edu with your thoughts and solutions!

In conclusion, the economics of AA ecosystem depends on the incentives of the 4 stakeholders: Financial Information Users, Financial Information Providers, Account Aggregators, Consumers. It also depends on the state of the world they are operating in: technology, markets and regulation. Given our understanding of the different components of the AA ecosystem, we can now make projections about the growth of this new business model and hypothesise on key pain points that lead to lower adoption of AA ecosystem.